U.S. construction companies will face many challenges in 2023, from economic uncertainty to high material costs to labor shortages. Our 2023 construction industry outlook explores these trends to help you plan for the year ahead.

2022 was a mixed bag for the U.S. construction industry. Despite higher infrastructure spending and an uptick in overall construction activity coming out of the worst of the pandemic, the year was filled with challenges such as high inflation, rising rates, and supply chain issues.

What challenges might construction companies face in 2023?

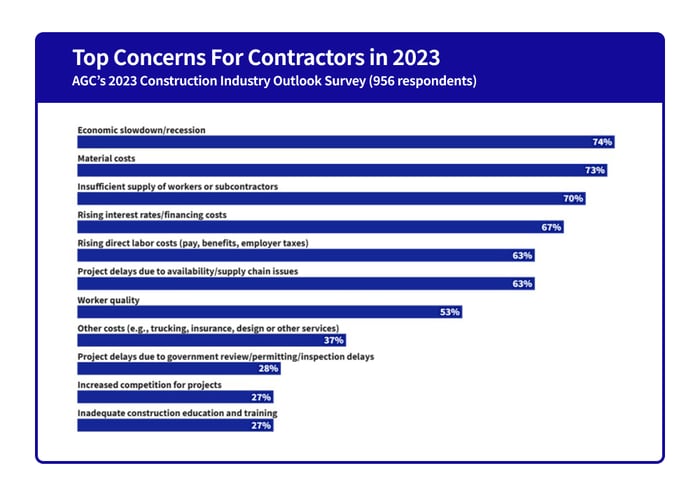

According to Associated General Contractors of America’s 2023 Construction Outlook National Survey of over 1,000 U.S. construction companies, the top concerns for contractors in 2023 are economic uncertainty, rising construction costs, and labor shortages.

Source: AGC - Chart prepared by Smart Construction in Flourish

These are not new issues, but their combination is creating a uniquely challenging environment for construction companies today.

In this post, we will take a closer look at these concerns and explore implications for construction companies in 2023, as well as strategies to navigate these challenges using technologies like Smart Construction Field, Office, and Dashboard.

Dealing with Economic Uncertainty

Nearly 75% of respondents to AGC’s 2023 Outlook survey indicated that they are concerned about a recession or economic slowdown in 2023.

Those that remember the Great Recession of 2007-2009 will remember the dramatic effects it had on the U.S. construction industry. Millions of construction industry workers lost their jobs and many companies had to close up shop. This fear has started to creep into the industry again at the beginning of 2023.

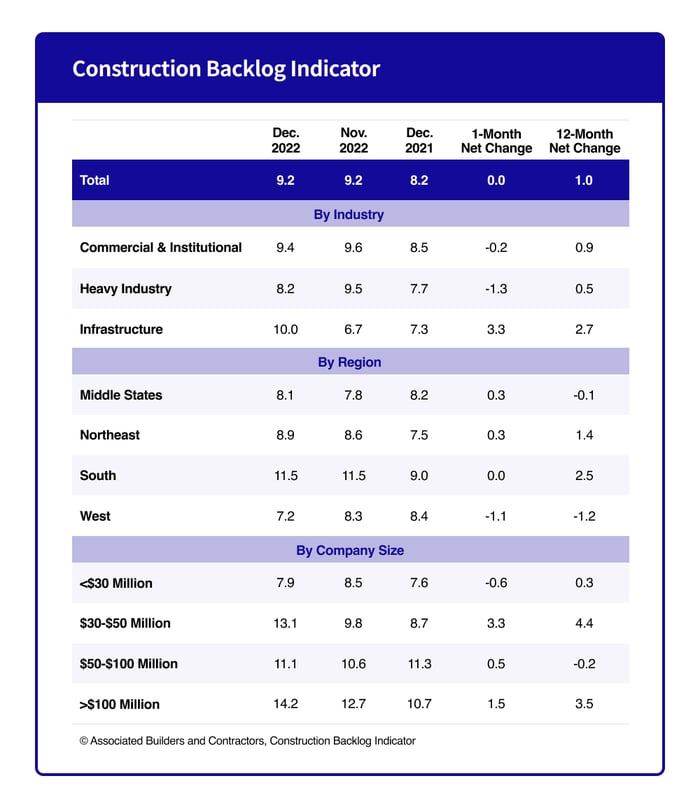

Despite recession fears, the Construction Backlog Indicator – a forward-looking national economic indicator that reflects the volume of work that will be performed by commercial and industrial contractors in the months ahead – remained flat in December 2022 at the highest level since mid-2019. This figure indicates that projected construction activities are stable overall, with infrastructure construction leading the way.

Source: ABC

Infrastructure spending bills are going into effect despite the economic environment, indicating that contractors with more infrastructure/government projects might be in a good position if the economy takes a turn for the worse.

On the other hand, rising financing costs and recession risk could limit the volume of commercial projects that move forward this year. If commercial projects don’t move forward, many contractors will struggle to find enough jobs to cover costs.

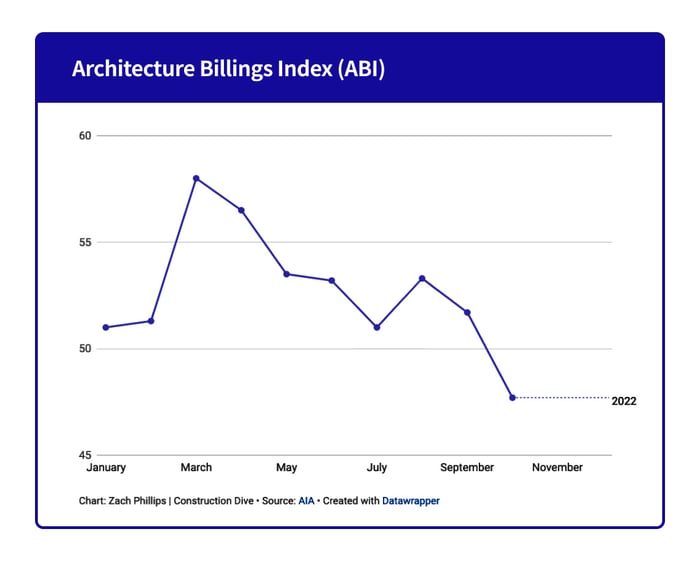

The Architecture Billings Index (ABI) gives more indication that commercial construction activity could slow in 2023. The ABI dropped below 50 in October for the first time in 2022. An ABI reading above 50 indicates that new construction projects are being planned, while a reading below 50 indicates a decrease in new projects from the previous month.

Source: Construction Dive

The risk of a nationwide economic slowdown or recession looms large for construction companies. If fewer construction projects are started and completed in 2023, managing resources will become increasingly important for contractors. The contractors that can control costs and win projects in areas less affected by recession (e.g., public works, infrastructure) stand the best chance of thriving through a possible downturn.

Regardless of how the economic situation plays out, construction companies should prepare for any outcome. Implementing technology is one way to deal with the uncertainty ahead. Digitization can help contractors produce more competitive bids, understand & manage costs more effectively, and keep projects on track, all of which will be critical to maintaining margins and surviving a downturn should it come. Smart Construction Office and Field are made for this kind of situation. They help you plan more effectively and track projects and costs in real-time, a big advantage compared to paper-based tracking or “eyeballing” progress.

Managing High Construction Costs

Even if a recession doesn’t materialize, construction costs are still rising across the industry, from financing to materials to labor. High costs and cost volatility are making it more difficult for companies to finish projects on time and on budget.

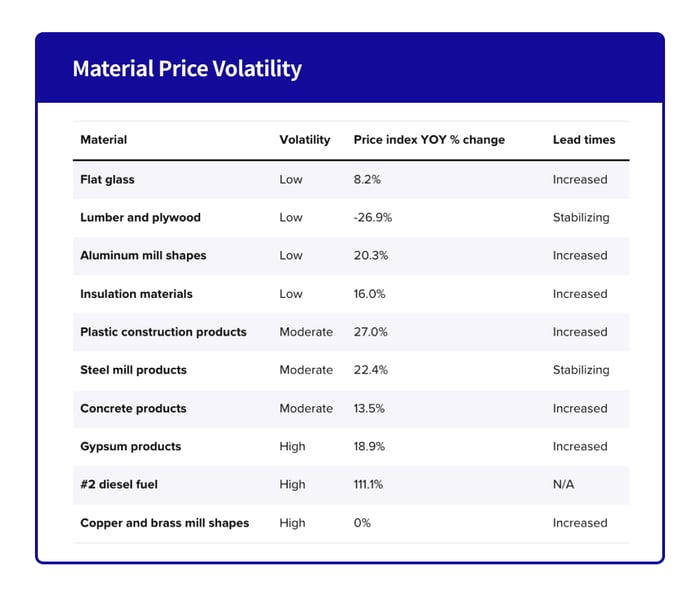

Over 70% of respondents to AGC’s survey said that they are concerned about material costs in 2023, and for good reason. The cost of construction materials has increased 40% since February 2020, despite a slight decline in recent months, according to ABC.

Source: Construction Dive

Material costs are still volatile as inflation and supply chain issues continue to affect availability of key construction materials. Additionally, lead times for many construction materials have increased dramatically over the past year. Many companies will be pressured to purchase more materials than they currently need to avoid future project delays, which will increase overall costs in the short term.

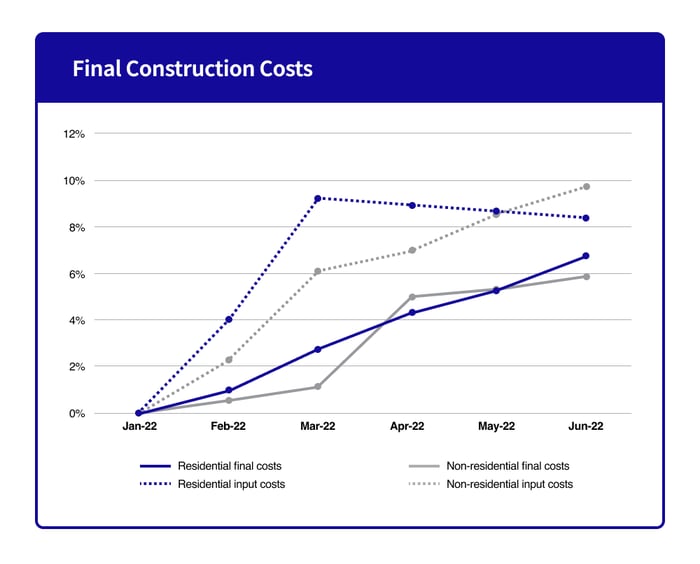

The increase in material costs has led to a consistent gap between input costs and final costs for construction projects over the last year, as the chart below shows.

Source: JLL (December 9, 2022)

Unfortunately, many construction companies struggle to track their costs effectively because they are too busy, short-staffed, or not tracking costs automatically with technology. Therefore, rising costs may not be passed along to clients, reducing overall project margins.

In an economic slowdown, slim margins or losses on individual projects could be catastrophic for a contractor. Understanding your business in real-time and adapting quickly to changes in the market and on job sites will be critical for construction companies in 2023.

Construction companies need to be able to track construction costs accurately to identify potential overruns vs. estimates. Using technology to track actual material, labor, and equipment costs in real-time can help contractors identify issues and adjust project plans proactively to avoid losses on a project. Accurate cost tracking can also increase the accuracy of bids, leading to more project awards and fewer surprises as projects are completed.

Construction software like Smart Construction can improve project and cost tracking and increase communication between job sites and office workers. This can make all the difference when costs are high and bids are more competitive.

Overcoming the Labor Crunch

Construction companies aren’t just facing rising financing and material costs. Labor shortages and rising wages are also putting pressure on construction companies. Many contractors are struggling to find enough workers, resulting in projects taking longer and costing more. This trend is set to worsen in 2023, as evidenced by the over 70% of AGC survey respondents that are concerned about labor supply going into the new year.

Construction employment surprisingly grew 3.3% from November 2021 to November 2022, but that growth did not fill the labor gap for most contractors. Around 80% of contractors are still having difficulty finding workers, and most respondents to AGC’s outlook survey expect those difficulties to persist.

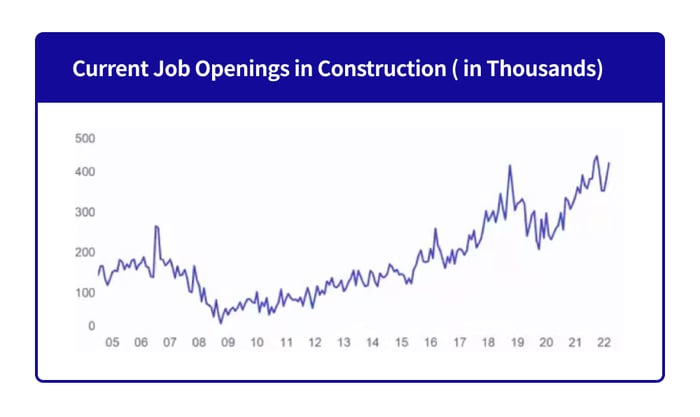

According to ABC’s analysis of Bureau of Labor Statistics data, nearly 390,000 construction job openings remained unfilled in November 2022, a 6% increase compared to the same period in 2021 and close to a record high.

Source: Bureau of Labor Statistics data analyzed by Dodge Construction Network

The gap between labor supply and demand is clearly widening.

AGC’s outlook survey shows that 69% of contractors hope to hire in the coming year, and only 11% expect to reduce their headcount. To attract workers, 72% of survey respondents increased base pay rates in 2022 and about a third boosted bonuses and benefits.

Construction companies clearly want to retain workers as they are increasingly difficult to find, but rising wages coupled with higher material costs and project delays could lead to a significant financial burden to construction companies. Labor shortages can also pose safety and health risks. Over 80% of contractors worry about this according to AGC’s survey, the biggest threat respondents identified by far.

The construction industry has been struggling with labor shortages for decades. Technology is just now starting to fill some of the gap.

As the old, unsafe, and physical image of the construction industry is failing to attract new construction workers, skilled workers are becoming more valuable and new technological solutions such as machine control equipment and project management software are being adopted more widely. These solutions can help contractors become more efficient, productive, and safer, while also attracting a new generation of skilled and tech-savvy workers.

The labor shortage issue will not be solved in a day as it has been ongoing for decades, but companies that adopt technology solutions to maximize their efficiency will have a competitive edge over those that don’t. Imagine the first company to have a full fleet of equipment autonomously operating day and night to beat all their competition. The future you imagine might be closer than you think.

How Smart Construction Can Help

It’s clear that construction companies will deal with numerous challenges in 2023, including:

- Economic uncertainty and recession risk

- Supply chain issues and rising material costs

- Rising labor costs and labor shortages

Construction companies that can effectively track and manage costs, produce accurate bids, and complete projects on time and on budget will have an advantage in 2023 and into the years ahead. This will not be easy in the current environment, but technology can help.

Difficult times are great times to invest in tools that increase productivity and efficiency – tools like Smart Construction Software. Smart Construction can’t hire employees for you or reduce your input prices, but we can help you use technology to improve productivity and efficiency while managing the major risks facing your business.

Smart Construction Field, Office, and Dashboard help companies digitize their operations. This facilitates immediate communication between the office and the field, improves record keeping, and gives you a real-time view of what’s happening on your job sites. You have a better chance of success when you improve your planning and communication, know your costs, and give your workers the tools they need to be more productive than ever.

Additional details on Smart Construction Solutions

Smart Construction has a variety of offerings and a team of optimization consultants that can help your company create smart cost control processes, increase communication, and democratize data amongst project stakeholders.

- Smart Construction Field gives field workers, foremen and even subcontractors access to detailed work plans and enables them to collect field data – timecards, equipment maintenance, and safety logs – quickly and accurately.

- Smart Construction Office gives managers the ability not only to plan projects but also to track their progress and costs in near real time due to its seamless connection with Smart Construction Field. Gone are the days where managers spend hours updating schedules having to cross check information across multiple systems. AI-powered risk detection alerts them to problems automatically and provides deep insight into the causes.

- Smart Construction Dashboard gives managers a 3D visual picture of the jobsite as well as automated progress updates allowing them to keep a closer pulse on their projects as they progress.